In a recent development, the Government of [Country] has officially confirmed the imposition of a 25% Goods and Services Tax (GST) on cars priced above Rs. 40 lacs. The decision, outlined in the new Statutory Regulatory Order (SRO) 370(I)/2024 by the Ministry of Finance and Revenue, signifies a significant change in the taxation structure for high-end vehicles.

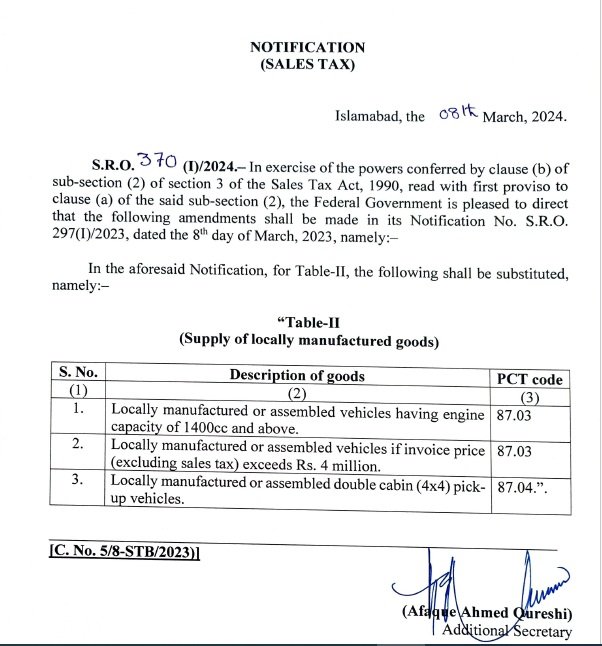

Amendments to SRO 297(I) 2023:

The Ministry, in its announcement, highlighted the amendments made to the previous notification No. SRO 297(I) 2023, dated March 8, 2023. According to the revised SRO 370(I)/2024, the 25% GST will be implemented on:

- Locally manufactured or assembled vehicles with an engine capacity of 1400cc and above.

- Locally manufactured or assembled vehicles with an invoice price (excluding sales tax) exceeding Rs. 4 million.

- Locally manufactured or assembled double cabin (4x) pick-up vehicles.

Clarification on Sales Tax:

An interesting facet of the new amendments is the clause regarding the exclusion of sales tax from the calculation. This means that the 25% GST will be applied to the car’s price, excluding the sales tax. To elucidate, a Suzuki official informed PakWheels.com that while certain variants of Cultus and Swift are priced over Rs. 4 million, only the Swift GLX falls within the purview of the new tax when sales tax is excluded. This adds a layer of complexity to the implementation, making it essential for consumers and industry players to carefully assess the impact.

Impact on Car Models:

While the imposition of the 25% GST primarily targets high-end vehicles, it leaves room for speculation regarding its effect on popular models such as Honda City, Toyota Yaris, and Proton Saga. Although these models fall within the price range, the announcement encourages consumers to await official statements from the respective companies regarding the revised pricing under the new SRO.

The government’s decision to impose a 25% GST on cars priced above Rs. 40 lacs marks a significant shift in the automotive taxation landscape. As the industry awaits official announcements from car manufacturers regarding the adjusted prices, consumers are advised to stay informed and anticipate potential changes in the cost of their preferred vehicles. The coming days will undoubtedly bring more clarity on the extent of the impact and the adjustments required in the automotive market.